How Medicare Graham can Save You Time, Stress, and Money.

How Medicare Graham can Save You Time, Stress, and Money.

Blog Article

The 6-Second Trick For Medicare Graham

Table of ContentsNot known Details About Medicare Graham Rumored Buzz on Medicare GrahamThe 5-Minute Rule for Medicare GrahamFacts About Medicare Graham RevealedFacts About Medicare Graham UncoveredMedicare Graham for DummiesMore About Medicare GrahamThe Ultimate Guide To Medicare Graham

In 2024, this threshold was evaluated $5,030. As soon as you and your plan invest that quantity on Part D drugs, you have actually gotten in the donut hole and will certainly pay 25% for medicines moving forward. When your out-of-pocket prices reach the second threshold of $8,000 in 2024, you run out the donut hole, and "disastrous coverage" starts.In 2025, the donut opening will certainly be mostly eliminated in support of a $2,000 restriction on out-of-pocket Part D drug investing. As soon as you hit that threshold, you'll pay absolutely nothing else out of pocket for the year.

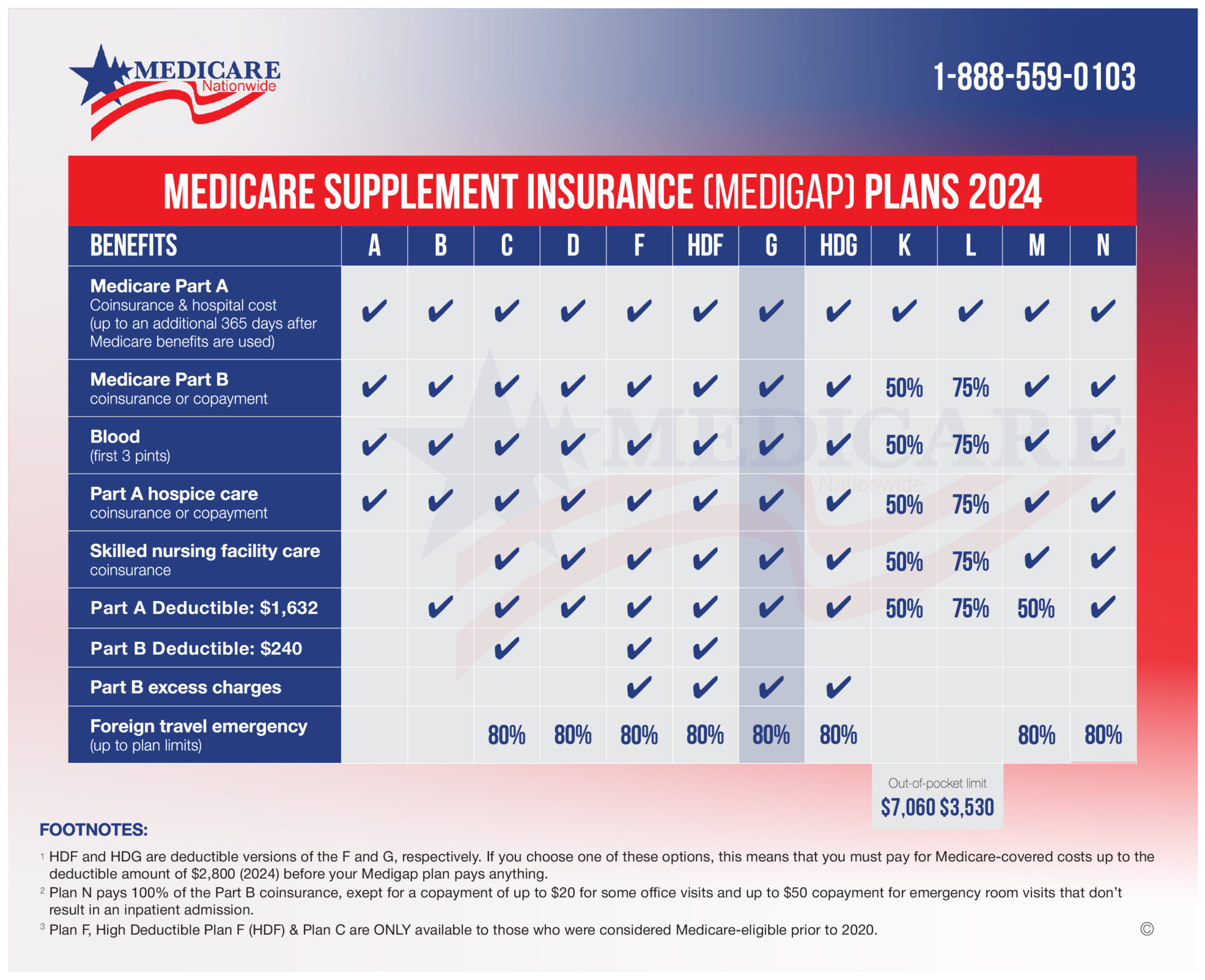

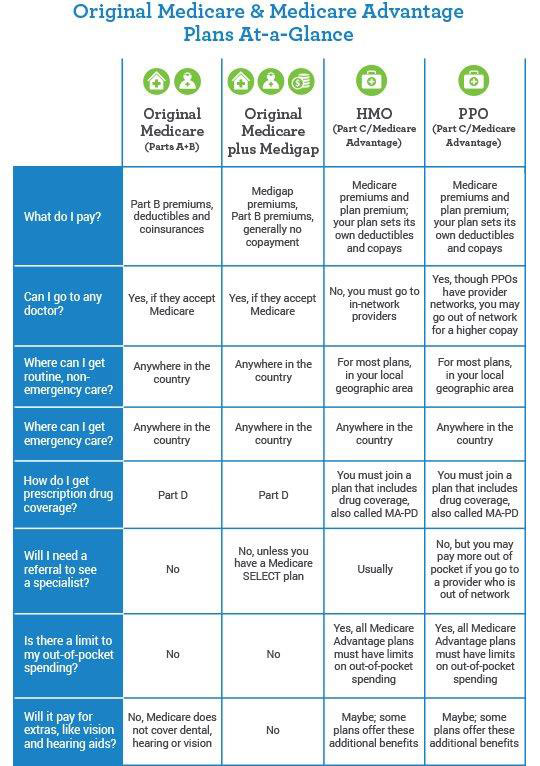

While Medicare Component C works as an alternative to your initial Medicare plan, Medigap collaborates with Parts A and B and helps load in any type of protection voids. There are a couple of essential points to learn about Medigap. Initially, you need to have Medicare Components A and B before acquiring a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

Medicare has actually progressed over the years and currently has four components. If you're age 65 or older and receive Social Security, you'll immediately be registered in Component A, which covers hospitalization prices. Parts B (outpatient solutions) and D (prescription medication advantages) are voluntary, though under particular circumstances you might be automatically signed up in either or both of these as well.

The 6-Second Trick For Medicare Graham

This write-up explains the kinds of Medicare plans offered and their protection. It likewise supplies recommendations for people who take care of member of the family with handicaps or health conditions and wish to handle their Medicare affairs. Medicare contains 4 parts.Medicare Component A covers inpatient hospital care. It also includes hospice care, proficient nursing center care, and home health care when an individual meets specific criteria. Monthly premiums for those that require to.

buy Component A are either$285 or$ 518, depending upon the amount of years they or their spouse have paid Medicare tax obligations. This optional insurance coverage needs a regular monthly premium. Medicare Part B covers clinically essential solutions such as outpatient physician check outs, diagnostic services , and preventative solutions. Personal insurance companies offer and administer these plans, yet Medicare needs to approve any kind of Medicare Benefit plan prior to insurance providers can market it. These plans give the very same protection as parts A and B, yet numerous also consist of prescription medication coverage. Regular monthly premiums for Medicare Advantage plans often tend to depend upon the location and the plan a person selects. A Part D strategy's coverage relies on its expense, medicine formulary, and the insurance coverage company. Medicare does not.

The Only Guide to Medicare Graham

normally cover 100 %of clinical costs, and the majority of plans need an individual to fulfill a deductible before Medicare spends for clinical solutions. Part D commonly has an income-adjusted costs, with higher premiums for those in higher earnings braces. This relates to both in-network and out-of-network healthcare experts. Out-of-network

The Definitive Guide to Medicare Graham

care incurs additional costsAdded For this kind of plan, administrators establish what the insurer spends for medical professional and healthcare facility protection and what the plan owner need to pay. A person does not require to pick a health care medical professional or acquire a referral to see a specialist.

The expenses and benefits of different Medigap plans depend on the insurance policy company. When an individual begins the plan, the insurance company variables their age into the premium.

Some Known Details About Medicare Graham

The rate of Medigap intends varies by state. As noted, costs are lower when a person buys a plan as quickly as they get to the age of Medicare qualification.

Those with a Medicare click to read more Benefit strategy are ineligible for Medigap insurance. The time might come when a Medicare strategy holder can no longer make their very own decisions for reasons of psychological or physical wellness. Before that time, the person should mark a trusted individual to offer as their power of lawyer.

The person with power of lawyer can pay bills, data tax obligations, collect Social Protection benefits, and pick or alter healthcare strategies on part of the insured individual.

The Single Strategy To Use For Medicare Graham

Caregiving is a requiring job, and caretakers frequently spend much of their time satisfying the demands of the individual they are caring for.

Depending on the specific state's laws, this might include working with family members to offer care. Because each state's policies differ, those seeking caregiving settlement have to look right into their state's demands.

About Medicare Graham

The insurance provider bases the original premium on the individual's present age, yet costs climb as time passes. The rate of Medigap intends differs by state. As kept in mind, rates are reduced when an individual acquires a plan as quickly as they get to the age of Medicare qualification. Specific insurer might additionally supply price cuts.

Those with a Medicare Advantage plan are ineligible for Medigap insurance. The moment might come when a Medicare strategy holder can no longer make their own choices for factors of psychological or physical wellness. Prior to that time, the individual ought to designate a trusted person to work as their power of attorney.

Unknown Facts About Medicare Graham

A power of lawyer paper permits another individual to conduct organization and choose on behalf of the guaranteed person. The individual with power of attorney can pay bills, documents taxes, accumulate Social Protection benefits, and pick or change medical care plans on part of the insured individual. An alternative is to call someone as a health care proxy.

Caregiving is a requiring job, and caretakers frequently spend much of their time fulfilling the demands of the person they are caring for.

Report this page